Whose Mind Is It Anyway!

Relax | Black and White Blobs | Robo Rats | Headbanging Caterpillar

(read in sequence, please don't scroll down)

Before we begin, lets have a "thought experiment" :)

...

.

Rest yourself. Relax. Be in a place where you are not disturbed.

...

.

Now close your eyes and focus on your thoughts... just observe them... let them come and let them go... don't resist them... just be there for couple of mins and come back here...

...

.

.

.

Please do, would be worth it

...

.

.

So what did you experience? Where did your thoughts began? Where did they actually end up? Where all did you wander?

...

Let's do something again... Go in the same space and...

DON'T THINK...

Yes... just stop thinking about anything. Be thoughtless and come back....

..

Do it, I am waiting... :)

How was it?

If you were able to keep your mind away from a any thought.. you need not read any further. You have attained bliss :). Others, mere mortals, you may continue...

So what are these thoughts? Where do they come from?

What happens when we say we are thinking?

Do we control what we are going to think? How free are we when it comes to thinking?

"It may sound extremely complicated, but it is surprisingly easy to test this idea. Next time a thought pops up in your mind, stop and ask yourself: ‘Why did I think this particular thought? Did I decide a minute ago to think this thought, and only then did I think it? Or did it just arise in my mind, without my permission or instruction? If I am indeed the master of my thoughts and decisions, can I decide not to think about anything at all for the next sixty seconds?’Just try, and see what happens."

- Yuval Noah Harari in Homo Deus

This post is about how thoughts come to us and how they shape what we do.

For this, I am relying on some books and articles that I have read, especially Sapiens, Homo Deus, Thing Fast and Slow, Power of Now, etc. along with certain other programs and experiences that I have gone through that has helped me look at my own thought patterns. Hence, strictly based on desktop research and hypotheses that I carry. These are just some musings that I am sharing.

Small Voice

We all have a small voice. Something that reside in our mind. This is probably the same voice that just asked "What small voice?"

Its a constant process whereby the biochemicals or electric signals in our brain are constantly evaluating the world around us, trying to give us an edge to survive. These signals just try to guess the situation that we are in by looking back in its "Experience Bank", trying to make a sense of it.

But what if certain situation is not in your experience bank?

Here's an example... can you tell what this is?

What do you see here??

Right now, your brain is probably going crazy and dipping into your experience bank and trying to make a sense of this picture... trying to guess what best these black and white blobs are are. This is what our mind does always, trying to look for a pattern from the past for a situation that we are in.

Kids don't know that they have to be careful while crossing the road or to be careful with hot stove cause they don't have any pattern concerning these life situations.

However, when they experience what its like touching a hot stove or when they learn from other's experience, like watching it on TV or parents' constant nagging about being careful on the road, they form a pattern of this bad experience or in other words form an "opinion".

Thus, as we grow up, our millions and trillions of experiences, conscious or unconscious, shape which of our neurons get fired when we are in a "similar" situation. A lot depends not on what you have seen in this world, but more on what the world has shown you.

(Did we actually choose to get goose bumps and feel proud when we see Indian flag fluttering high in mountains with the patriotic music running in the background?)

This automatic process of constantly assessing your life situation is that "small voice" that keeps on running in your head, constantly dictating how "you" should be reacting, behaving and feeling!

By the way, if your pattern seeking mind is still trying to guess what those black and white blobs were in the above picture.. it was ...

...

.

.

"The world" has now shown you what those black and white blobs are. Now that its in your experience bank.. when you look at this picture or another random black and white patterns again...

the small voice will probably tell you its a snake .. and that you should feel in a way how you generally feel when you look at a snake picture... (even when this picture actually is not a snake!)

This is just a small example. But there are constant events that happen in our life whereby our brain neurons get fired in a certain way, shaping our thoughts and beliefs that drive our own behavior and decisions.

Decisions

Get present to what all you are doing right now... physically...

slouching on a chair?... biting nails?... scratching?... where are your hands?... how are your legs placed?

Did you decide to do all that?

We all have some small habit that keeps us comforted and lowers our anxiety.

Again, these are the small things. But do we do the same things when it comes to big decisions from our life? Do we have fixed patterns on how we decide onto things?

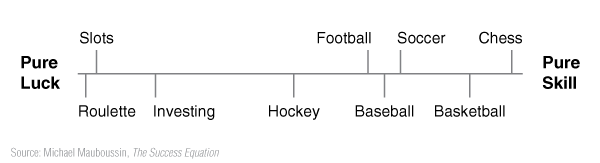

Whatever we decide to do, consciously or unconsciously, the same mechanism is at work. Decisions are nothing but predictions and best guesses, based on again, our experience bank.

"Predictions are basically the way your brain works. It’s business as usual for your brain. Predictions are the basis of every experience that you have. They are the basis of every action that you take."

- Lisa Feldman Barrett, Neuroscientist

It is this prediction business of mind that chooses emotions, decisions and how we react to situations for us. A lot of decisions and actions are already decided by the small voice even before we actually "think" of taking a decision... A lot of decisions about a person are already taken (or opinions formed) for a person even before we speak with them...

The small voice actually is faint voice. We can listen to it only faintly, that too when we actually sit down to not think at all. (remember "don't think anything" experiment above?). A vast magnitude of the small voice is hidden deep inside in our neural patterns, some of which are even primal, like hogging onto as much sweets as we can, whenever we find them.

So, based on above, do we control anything? Do we really have a free will..

Yuval Noah Harari has articulated the free will pretty well.

(caution - this may actually be a bit depressing thought :) )

"Today we can use brain scanners to predict people’s desires and decisions well before they are aware of them. In one kind of experiment, people are placed within a huge brain scanner, holding a switch in each hand. They are asked to press one of the two switches whenever they feel like it. Scientists observing neural activity in the brain can predict which switch the person will press well before the person actually does so, and even before the person is aware of their own intention. Neural events in the brain indicating the person’s decision begin from a few hundred milliseconds to a few seconds before the person is aware of this choice. The decision to press either the right or left switch certainly reflected the person’s choice. Yet it wasn’t a free choice. In fact, our belief in free will results from faulty logic. When a biochemical chain reaction makes me desire to press the right switch, I feel that I really want to press the right switch. And this is true. I really want to press it. Yet people erroneously jump to the conclusion that if I want to press it, I choose to want to. This is of course false. I don’t choose my desires. I only feel them, and act accordingly.

For example, robo-rats could help detect survivors trapped under collapsed buildings, locate bombs and booby traps, and map underground tunnels and caves. Animal-welfare activists have voiced concern about the suffering such experiments inflict on the rats. Professor Sanjiv Talwar of the State University of New York, one of the leading robo-rat researchers, has dismissed these concerns, arguing that the rats actually enjoy the experiments. After all, explains Talwar, the rats ‘work for pleasure’ and when the electrodes stimulate the reward centre in their brain, ‘the rat feels Nirvana’. To the best of our understanding, the rat doesn’t feel that somebody else controls her, and she doesn’t feel that she is being coerced to do something against her will. When Professor Talwar presses the remote control, the rat wants to move to the left, which is why she moves to the left. When the professor presses another switch, the rat wants to climb a ladder, which is why she climbs the ladder. After all, the rat’s desires are nothing but a pattern of firing neurons. What does it matter whether the neurons are firing because they are stimulated by other neurons, or because they are stimulated by transplanted electrodes connected to Professor Talwar’s remote control? If you asked the rat about it, she might well have told you, ‘Sure I have free will! Look, I want to turn left – and I turn left. I want to climb a ladder – and I climb a ladder. Doesn’t that prove that I have free will?"

Time for some creepiness

Recently I came across a creepy TED talk by Ed Young (watch here). It is about discovery of certain parasites, animals and organisms that live on bodies and brains (yes brains!) of other animals and organisms and control their neural networks for their own benefits.

There are parasitic wasps that lay eggs in caterpillar's head. The eggs that hatch eventually go on to control caterpillars brain to defend their siblings, making caterpillar bang its head... a headbanging caterpillar... put on some rock music and see the below video..

There is an example of Toxoplasma Gondii (pyaar se usse Toxo bulaate hai) which infect mammals. When Toxo infects rat or a mouse, it makes them into cat seeking missiles.

"If the infected rat smells the delightful odor of cat piss, it runs towards the source of the smell rather than the more sensible direction of away."

"This thing is a single cell. This has no nervous system. It has no consciousness. It doesn't even have a body. But it's manipulating a mammal? We are mammals. We are more intelligent than a mere rat to be sure, but our brains have the same basic structure, the same types of cells, the same chemicals running through them and the same parasites."

The idea that Ed Young wanted to present was that these "manipulations" are common in the world around us and there are chances that even we can be infected by such parasites considering our construct as a mammal is same as that of rats or a mouse.

Mind or brain is nothing but a hardware that fires some biochemicals or electric pulses to make us happy or sad. It process its information much like a PC or a mobile phone on which you are reading this (A bit exaggeration, but you get the point).

Do we actually control how and when these neurons fire? Do we really choose how we behave? Do we really decide what we want? Or we are made to do something?

We don't!

Our thoughts, our actions are shaped by things external to us. So can we call it ours?

However, we have something which probably no other life form has. Something that can help us re-wire and create. But that's probably a discussion for some other post.

But what I'll do is just leave you with a quote from the movie Inception.

Sources:

https://vialogue.wordpress.com/2018/01/03/ted-lisa-feldman-barrett-you-arent-at-the-mercy-of-your-emotions-your-brain-creates-them/

https://www.wbur.org/npr/470535665/can-we-fall-prey-to-hidden-parasites

various other web sources, books and articles.