"The whole village could not sleep. Even I was under stress as to what will happen. I had Rs 2,000 in 500 notes."

This was our young guide Raksha on what was the situation the day government announced demonetisation of 500 and 1000 notes. We were on a village home stay last trip last weekend. Raksha was our guide and was on a long Diwali break from her college in Wada.

When asked what's the impact of demonetisation on the people of small hamlet called Dehene (Maharashtra), she informed that most people here do not have so much money. People have been able to exchange money at a bank in Dolkham, a town 10 kms away from that village. On inquiring with other villagers, it appears that not all of their money is exchanged as yet. They are not able to even withdraw money from banks. Bank has been running low on cash. "Don't know when we will be able to exchange all the money. Who will go Dolkham everyday and stand in queue", said another villager.

They have not been able to move their harvest as well. Predominantly rice and nachni producing region, people here are unable to move goods easily because of cash crunch and uncertainty.

This village though may not be entirely dependent on agriculture. Many males from the village work in Mumbai or other town. Raksha's uncle Dashrath in fact works at a hydro power plant some 15 kms away. Being base village for Aaja parvat trek and such home stay initiatives, people here are not dependent on agriculture for their income. It is a seasonal occupation here and only surplus harvest is sold. Thus, Dehene may not be an ideal rural India to gauge impact of demonetisation in hinterlands.

But people here seemed happy that those with lots of money are losing sleep and being punished for their greed. Just like most salaried and organised players feel in the city. "The adhikaries would be spending sleepless nights. It is a good step by Modi" said Raksha.

Though it emerged that adhikaries there as well seems to be trying to find loopholes and convert their black money into legal tenders by depositing money in different names, distributing among keen, etc. (made me think if these influential people, who can misuse their position, be the reason for cash crunch at banks?)

So what will be the full impact? Will black money cease? Will unorganised economy turn organised? Will corruption go away? Does the costs involved justify potential tangible and intangible benefits?

It appears that I was left clueless even after my short on the road (toll less :-) )trip.

Google search says that the word "Complex", when used as an adjective means:

1. consisting of many different and connected parts.

2. denoting or involving numbers or quantities containing both a real and an imaginary part.

This is indeed a complex situation. An economy in itself is a Complex Adaptive System (CAS). A system made up of many micro level, partially connected structures that intermingle. The result of these intermingling is not a simple aggregation (i.e. not 1+1=2) but something different altogether. These micro level structures self organize to systemic changes or change initiating events with the intent of survival. This process results in increased survivability or robustness of macro structure. Demonetisation is one such change initiating event.

Trying to outguess outcomes or arrive at a linear "logical" consequences can be a futile exercise. Thus statements like "there will be short term pain, but good for the economy over long term" should be read as "I don't know, but this seems to be most likely scenario". Yes, our logic states that things will move from unorganised to organised will be better for the economy over long term. But there can also be any unknown unknowns that can work against this move. How will micro systems learn and reorganise? What impact each micro system will have on others? What will be the end result on the adaptive system called economy when things settle? Only time can tell.

In that sense, as an alternate view, government reacting to situation by bringing in new rules every day, as situations unfold, is a better strategy as compared to "pre-plan" everything and then implement. When we are dealing with CAS, one can never be fully prepared.

How things will unfold, only time will tell. All we can do is try to arrive at most likely scenarios (plural) and adapt accordingly.

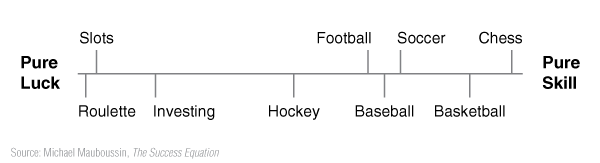

As an investor, I have learned that stock market (a complex adaptive system in itself) does not like uncertainty and is currently reacting to that. It will take its time to learn and organise itself from this event. There will be winners and there will be losers as the system tries to improve its robustness. Some people will be able to pick winners (Investing falls towards luck side of luck-skill conundrum) and will be called geniuses few years down the line whereas some will return to mediocrity. All one can try and do is have a process and build a portfolio with enough diversity of robust companies and try and improve portfolio survivability.