It's festival time. Festivities results in one very important annual ritual in every Indian household. The ritual of cleaning your house! It's time when every nook and corner of the house is turned upside down to make it spotless. There are many things associated with cleaning the house before Diwali. It is done to welcome Goddess Lakshmi or to welcome new year with the motto of "doing away with old and bringing in new".

This ritual happens in my home as well. It's a family affair. Things that require climbing and reaching out is done by male members. Recently, I was given the responsibility to clean the loft. Loft, an area of home that remain untouched for rest of the year. This is the time when old boxes and bags are removed and checked.

I realized there are 3 types of boxes or bags...

While some bags contain things that are kept with the hope of using them next year, there are also certain things that are no longer relevant and needs to be "donated" to maids and watchmen. Some items can be scrapped, providing that source of money to pay for bakshis to maids and watchmen.

Sometimes we also come across a third category are those boxes that brings the thought of "What the hell is that?" to mind. Boxes that are not touched for ages or we do not have any recollection of..

I realized there are 3 types of boxes or bags...

While some bags contain things that are kept with the hope of using them next year, there are also certain things that are no longer relevant and needs to be "donated" to maids and watchmen. Some items can be scrapped, providing that source of money to pay for bakshis to maids and watchmen.

Sometimes we also come across a third category are those boxes that brings the thought of "What the hell is that?" to mind. Boxes that are not touched for ages or we do not have any recollection of..

Some of these find their way to one of the above two categories and are either dumped back or scrapped.

On the other hand, there are some pleasant surprises in store too. Things that you've been looking for for a long time. Your favourite jacket or some memories. This year I stumbled upon the my childhood photographs, back from the days when photos were physical, rare and very valuable. Certainly cleaning the loft was worth the effort!

On the other hand, there are some pleasant surprises in store too. Things that you've been looking for for a long time. Your favourite jacket or some memories. This year I stumbled upon the my childhood photographs, back from the days when photos were physical, rare and very valuable. Certainly cleaning the loft was worth the effort!

Something similar goes with investments as well. There are a set of investors, whom I call as "Closet Investors" (can probably be rechristened as "Lofty Investors"), who get active during bull markets and shy away from it after making losses when market crashes. They just resurface every bull market. They hold shares of 100s of companies in their closet, some dating back to pre-demat days as well, hard, physical share certificates, forgetting they ever existed or were left behind by parents.

Like Diwali, when bull market returns, these investors conduct the ritual of checking their lofty portfolio. Some companies that are making them some money are sold of for whatever profits they have made for them while other loss making ones are kept back on the loft, hoping they will pay back some day!

There are some positive surprises in store too...

Like Diwali, when bull market returns, these investors conduct the ritual of checking their lofty portfolio. Some companies that are making them some money are sold of for whatever profits they have made for them while other loss making ones are kept back on the loft, hoping they will pay back some day!

There are some positive surprises in store too...

Have heard quite a few cases where old forgotten investments for some people turned out to be worth millions. Physical shares of Bajaj Auto found while moving houses worth Rs 80 lakhs, investment in yester year's bluechip textile company turned out to be worth Rs 60 lakhs on account of real estate boom, a mis-selling by a private bank sales person of Rs 25000-30000 in some closed ended real estate fund turned out to be worth Rs 4.5 lakhs (a structured product by a prominent AMC!).

One of the veteran from the industry had once told me that all this analysis and strategy is meaningless. Over the years, he has observed that it is wise to stick to 15-20 stocks based on informed decision making. One should be ready to lose money in some of them whereas let winners make up for that and over the years most of us will be much better off than investing very actively.

However, I have also seen many other portfolios that has probably done a mediocre job for investors. They hold nothing but collector's edition stocks and have done a mediocre job for the investors.

Michael Mauboussin has defined success as :

Success = Skill + Luck

Great Success = Skill + Great Luck

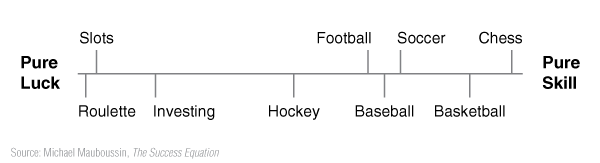

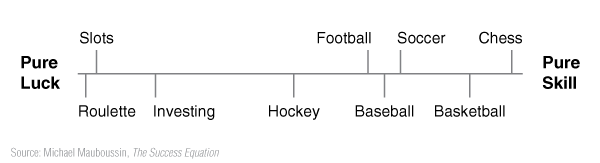

I think all these anecdotes and experiences largely are a function of the luck element involved with investing. They are more towards luck as compared to skill. In his book "The Success Equation", Michael has placed investing success more as a function of luck vs skill. This should not be taken in wrong context. Skill is very much required for investing success, but it plays out over a long period of time. In the interim, luck can play a major role in driving portfolio returns.

Picture source

Thus, some of those lofty investors have an interesting dinner table conversations on how they had great vision in identifying those great investing trends while some continue to hope for being right every bull market.

As for the lessons, I hope to make "checking my portfolio" a systematic affair rather than just during Diwali (bull markets). Just like we do not clean our loft everyday, it also does not make sense to check the portfolio everyday. But whenever we do, just need to ensure to properly identify useful things from the hopeful things. If things are not used for say 2 or 3 years, they ought to be scrapped away to pay for bakshis or other useful things. In the same way, if investment thesis has not played out over last 2 or 3 years, instead of hoping to be right, it might be beneficial to have a re-look at it altogether.

Happy Cleaning...

Picture source

Thus, some of those lofty investors have an interesting dinner table conversations on how they had great vision in identifying those great investing trends while some continue to hope for being right every bull market.

As for the lessons, I hope to make "checking my portfolio" a systematic affair rather than just during Diwali (bull markets). Just like we do not clean our loft everyday, it also does not make sense to check the portfolio everyday. But whenever we do, just need to ensure to properly identify useful things from the hopeful things. If things are not used for say 2 or 3 years, they ought to be scrapped away to pay for bakshis or other useful things. In the same way, if investment thesis has not played out over last 2 or 3 years, instead of hoping to be right, it might be beneficial to have a re-look at it altogether.

Happy Cleaning...